Getting your kids to become financially savvy is a challenge these days, especially when everywhere they turn there’s temptation to buy, buy, buy. How do you get them to change their mindset to save, save, save? Here are five tips to get you started:

- Set a financial goal

It’s a lot easier to say no to buying the latest phone, shoes, jeans, or gadget, when kids have a specific financial goal in mind that they’re trying to reach. Help them set realistic goals—both for the short-term and the long-term. Whether it’s saving $100 for the month, or for the year, the skill of setting and reaching financial goals is a great foundation for their financial future. - Give kids an allowance

Many parents give their kids an allowance in exchange for doing chores, or as a way to learn about money. The average is $65/month. Maybe you’re in that category, or maybe a smaller allowance works best with your family’s budget. Whatever the amount, a regular allowance helps kids practice handling money. Encourage them to remember that there are three things they can do with their money—save, spend, and share. - Let them make money mistakes

Now’s not the time to be a helicopter parent. Let your kids make some money mistakes—better now with $50 than later with $5,000. We all know it hurts when you run out of money for something essential due to lack of planning, or excessive spending. A dose of reality at a young age will help them remember to be more responsible with money when it comes their way. - Encourage working or starting a business Encourage kids to earn money either by doing extra chores or starting a business. Not only is it a great way for them to reach their financial goals faster, it’s a huge confidence booster for them to know they are capable of earning their own money. For those parents with budding entrepreneurs check out Biz Kid$’ one-page business plan to get them on their way.

- Have a regular money conversation

You don’t need to be a financial whiz on Wall Street to help your kids become financially savvy. Get the conversation started by having a weekly money check-up with your kids about their progress, and share what you do know about money. Family money conversations can open the door to learning from each other’s mistakes and successes. Need ideas for topics? Check out the lesson plans from bizkids.com.

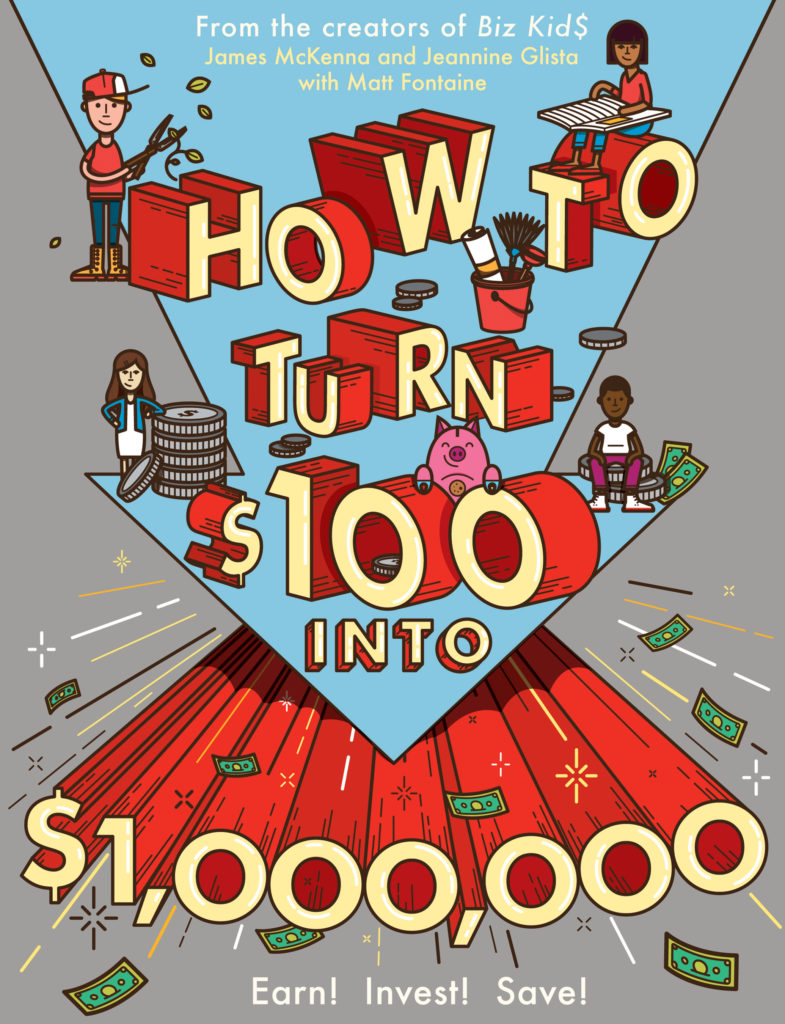

check out the book for more financial tips!

About the Book:

From the creators of Biz Kid$ and Bill Nye the Science Guy, here is a comprehensive guide for kids to the basics of earning, saving, spending, and investing money. Written in a humorous but informative voice that engages young readers, it’s the book that every parent who wants to raise financially savvy and unspoiled children should buy for their kids. It is packed with lively illustrations to make difficult concepts easy to understand—all as a way of building financial literacy, good decision-making, and the appreciation of a hard-earned dollar.

Buy the Book

Indiebound | B&N | Amazon | Workman

No Comments