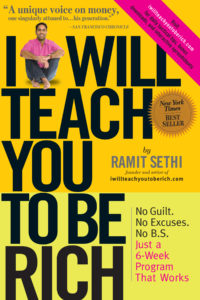

Last week I introduced my plan to become financially literate (and financially zen) by following the 6-week program outlined in Ramit Sethi’s hip book I Will Teach You to Be Rich. In my introductory post, I wrote of the preemptive agony I felt at the prospect of having to learn how to invest and how to create a conscious spending plan. In a nod to pop culture, I even said that I expected the experience to be about as fun as Harry Potter’s final battle with Lord Voldemort.

Last week I introduced my plan to become financially literate (and financially zen) by following the 6-week program outlined in Ramit Sethi’s hip book I Will Teach You to Be Rich. In my introductory post, I wrote of the preemptive agony I felt at the prospect of having to learn how to invest and how to create a conscious spending plan. In a nod to pop culture, I even said that I expected the experience to be about as fun as Harry Potter’s final battle with Lord Voldemort.

Well, during Week 2 (Beat the Banks), I found that optimizing my bank accounts is not all doom and gloom after all. In fact, the simple step of taking action—last week signing up for a credit card, and this week opening a high-interest online savings account—has made me feel powerful…unstoppable…INVINCIBLE. I’m basically the Rosie the Riveter of personal finance.

Her bulging biceps are almost as big as the nest egg I’m about to grow.

Her bulging biceps are almost as big as the nest egg I’m about to grow.

Not even a monstrous insect on the lam could stop me from completing my Week 2 task. That’s right: Last night, as I was sitting on the sofa, laptop at the ready, I caught sight of some movement out of the corner of my eye. I whipped my head around to take a look, already feeling a sense of dread wash over me. There it was: an insect the size of Moby Dick, lumbering calmly across my living room floor. It had wings. And I was the only one home. This is an example of what I like to call Erin’s Law: Giant bionic roaches and other fearsome creatures will only invade one’s home when all of one’s roommates are out, leaving one alone and defenseless in the face of the beast.

(Disclaimer: I’m not normally so skittish about bugs. A ‘fraidy cat I am not. But when they look like they could topple furniture, I think that is cause for alarm.)

Luckily, I was able to keep the beast at bay (by standing 10 feet away and trash-talking it aggressively) long enough for my roommates to come home and help me vanquish it (Jen trapped it under a bowl, slid a magazine between the bowl and the floor, and calmly carried it outside. Alive.) After it was safely out of sight, I could get back to business: the business of earning more money.

In I Will Teach You to Be Rich, Ramit advocates online banks like ING Direct and Emigrant Direct. These banks have eliminated overhead—meaning they have no branches, no tellers, and spend very little money on marketing. They pass this savings on to their customers in the form of lower fees (or no fees at all) and higher interest rates. Take ING, for example. When I compared ING’s Orange Savings Account with the savings accounts offered by my neighborhood bank, I found that the neighborhood bank offers an interest rate of between .01% and .50%. At the end of a year, the amount of money you’d earn at that rate is squat compared to ING’s average 1.00% rate. The best part about ING is that their account is simple and straightforward. Even their account disclosures (which are normally so long and tedious, you’d rather do anything—even clean the frathouse bathroom after an all-night rager—then read them) are written in plain English. Everything is explained up front.

Besides ING and Emigrant, HSBC also offers a great account with a high interest rate. The way I see it, you just can’t go wrong with one of these babies. And I would know, for I am Erin, Woman of Action and Purpose (well, maybe not when it comes to bugs).

No Comments