According to Catholic tradition, sometime between A.D. 98 and A.D. 117, St. Ignatius, Bishop of Antioch, was ordered by Roman Emperor Trajan to suffer a gruesome death among the wild beasts in the Roman Coliseum. It is said that the letters Ignatius wrote before his demise are “redolent with the spirit of Christian charity, apostolic zeal, and pastoral solicitude.”

Totally gratuitous photo of my friends and me at the actual Coliseum.

Totally gratuitous photo of my friends and me at the actual Coliseum.

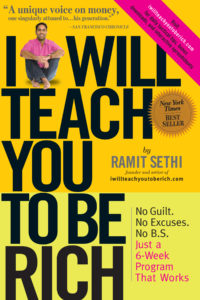

A more recent blogging tradition tells the tale of Erin, Assistant Editor of Workman, who in the year A.D. 2011 embarked on a similarly harrowing personal journey of self-mortification–but this was mortification of the wallet, not the flesh. Comparatively gruesome (but with a happier ending), Erin of Workman’s journey reached its apex in the creation of a conscious spending plan as advocated by personal finance guru Ramit Sethi, who is much nicer than Emperor Trajan, and also better looking. It is said that Sethi’s book I Will Teach You to Be Rich is “smart, bold, and practical. I Will Teach You to Be Rich is packed with tips that actually work” (J.D. Roth, editor, GetRichSlowly.org). Now those are virtues I can relate to.

Like Moses bringing forth water from a rock, I wrought my conscious spending plan (CSP) from years of neglect and worry over the state of my financial affairs. But when I hit Week 4 of Sethi’s 6-week plan, I couldn’t evade it any longer. I was about to step into the lion’s den–the jungle I had so weepingly anticipated in Week 1’s post.

Like Moses bringing forth water from a rock, I wrought my conscious spending plan (CSP) from years of neglect and worry over the state of my financial affairs. But when I hit Week 4 of Sethi’s 6-week plan, I couldn’t evade it any longer. I was about to step into the lion’s den–the jungle I had so weepingly anticipated in Week 1’s post.

Despite Ramit’s repeated assurances that a CSP is not a budget, I knew that devising one meant I would have to face the reality of the “spending” money I fritter away on little things like a sandwich here and there, and big things like a Banana Republic factory store shopping spree here and there. And I did face the reality, and though I was not happy to do so, I discovered some important things: 1) I CAN save money for my retirement, long-term, and short-term accounts, even under the yoke of New York City rent, and 2) my dad, as I shared in Week 2’s post, is freakishly on point about many matters of money management, having utilized Ramit’s envelope system long before Ramit made it explode in popularity. (That was hyperbole. But, seriously, try the envelope thing. It’s an extremely literal and simple way to delegate your spending money. It’s on page 115.)

In line with my new tradition of paying myself first, my next big vacation may be less Coliseum and more this…

But I think I can deal with that. There, the only animals are on the casino floor.

No Comments