I am a lot like Kerri Strug.

Remember the 1996 Olympic Games, when gymnast Kerri had to perform a second vault on an injured ankle in order to clinch the U.S. gold? Remember the drama–how she limped to the end of the runway? How she nailed the vault, landing neatly on both feet for one nanosecond before collapsing in pain? Remember how her coach Béla Károlyi carried her onto the podium to receive her gold medal? It was thrilling! Riveting! Patriotic!

…Kind of like my ascent to personal finance supremacy. (You may have noticed that throughout this series, I have made many bombastic comparisons. i.e., I’m the Rosie the Riveter of personal finance; I’m the Daniel “Rudy” Ruettiger of personal finance; I’m the Unsinkable Molly Brown of personal finance. What can I say? I just love a good historical/pop culture reference.)

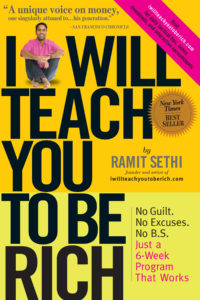

Six weeks after I began following the plan outlined in Ramit Sethi’s peerless book I Will Teach You to Be Rich, I feel…well, I feel a lot like I’ve fallen in love. I feel happier, giddier,  lighter of step. I also feel somewhat smug. This is because I can now go about my business with a daily worry load that is 82% lighter, because I now have full control over my finances. I know what accounts my money goes to and what bills are being automatically paid. I know that my money’s growing in my high-interest online savings account, my Roth IRA, and my investments. I know I’m not paying unnecessary fees–and, best of all, I know that any leftover cash is mine to spend as I please.

lighter of step. I also feel somewhat smug. This is because I can now go about my business with a daily worry load that is 82% lighter, because I now have full control over my finances. I know what accounts my money goes to and what bills are being automatically paid. I know that my money’s growing in my high-interest online savings account, my Roth IRA, and my investments. I know I’m not paying unnecessary fees–and, best of all, I know that any leftover cash is mine to spend as I please.

(And, boy, do I have plans for that fun money! Namely, this, this, or this.)

But–lest you think this is the end of the road–I do not wish to mislead. Though the best part about Ramit’s approach to personal finance is that it requires very little tinkering after the initial six-week period, it’s not completely hands-off. I’ll still monitor my checking account to prevent overdrafting, take a look at my credit card statement to ensure all charges are accurate, adjust my contributions to my 401(k), etc. But the effort this will require is minimal–and infinitely more bearable now that the foundations for fiscal peace of mind are all in place.

So, the stage is set. The audience waits with bated breath for the rise of the curtain. The instruments of my future wealth are finely tuned. As I look bemusedly back at my monetarily ignorant past, and ahead to a secure yet unknowable future, I recall the words of the great Hogwarts headmaster Albus Dumbledore: “And now, Harry, let us step out into the night and pursue that flighty temptress, adventure.”

1 Comment

Randall Gettel

April 9, 2012 at 1:12 pmI have been reading out many of your articles and i can state pretty clever stuff. I will make sure to bookmark your site.