I never thought it would be so simple and so painless to set up systems that enable me to automatically save and grow my money. Honestly, had I known that such an anxiety-free existence was within my reach, I could have gone from this…

…to this…

…much earlier in life!

(What can I say? I look good in a knit beanie.)

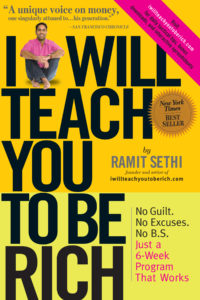

But here I am, halfway through the six-week plan to financial literacy outlined in Ramit Sethi’s superbly useful book I Will Teach You to Be Rich. If you’ll recall, as I anticipated beginning the program, I was quite downcast. But as I’ve completed each week’s tasks, my whole outlook has changed. In week 1, I—who had been living within my means but  jeopardizing my chances of getting good interest rates on future loans—bellied up to the bar and signed up for my first credit card (with the help of a friendly representative at my neighborhood bank). In week 2, I opened a high-interest savings account at an online bank, where I’ll be earning a dramatic .50-.95% more than I would if my money were sitting in a brick-and-mortar bank. And now, in Week 3 (Get Ready to Invest), I’ve upped my automatic contributions to my 401(k) in order to take advantage of my employer match—and I opened a Roth IRA and began funding it.

jeopardizing my chances of getting good interest rates on future loans—bellied up to the bar and signed up for my first credit card (with the help of a friendly representative at my neighborhood bank). In week 2, I opened a high-interest savings account at an online bank, where I’ll be earning a dramatic .50-.95% more than I would if my money were sitting in a brick-and-mortar bank. And now, in Week 3 (Get Ready to Invest), I’ve upped my automatic contributions to my 401(k) in order to take advantage of my employer match—and I opened a Roth IRA and began funding it.

You may be reading this and assuming that I’m a kazillionaire. I regret to inform you that I am not. And I think it will take a few weeks for me to adjust my contributions to my savings account and investments—now that I’ve increased those contributions, my take-home pay will be lower, and I’ll need to strike a balance between saving and investing aggressively while still covering my living expenses and having fun. But now that I’ve actually taken steps toward financial literacy, finding that balance will be a whole lot easier. And I just can’t overstate how relieved I feel to have actually taken those steps. For years, I worried about money, but felt so unequipped to manage my own money properly that I was paralyzed by the attempt. And look at me now! Tossing the terms investments and Roth IRA casually about, as if I had a poufy combover on my forehead and a reality show wherein cutthroat businesspeople compete to be my apprentice.

Well, Trump, you’re officially on notice. This girl is set on a path to overtake you in the arena of financial domination—and I’ve got much better taste.

No Comments