It would seem that, when it comes to personal finance, I have an appetite for (self-)destruction. Three years after college graduation, my levels of anxiety about money are so high that I wake up sweating clammily in my air-conditioned room. Every suggestion made casually by a friend—from the most innocuous (“Let’s grab a drink”) to the more obviously costly (“We should all go to Atlantic City for the weekend!”)—sets off a chain reaction of panic, as my brain struggles to ascertain whether my completely unmanaged budget allows such an indulgence. To dispense with hyperbole: I don’t live beyond my means, per se—I consciously try to limit splurges like dinner out, $12 martinis, and $85 theater tickets to a show that’s basically an extravagant, multilevel, live-action game of Clue played in a restored mansion (be still my theater-geek heart!). But neither do I have a real sense of exactly where my money’s going, and how I can save enough to eliminate worry about the future while still living comfortably in an urban area teeming with tasty, trendy temptations.

It would seem that, when it comes to personal finance, I have an appetite for (self-)destruction. Three years after college graduation, my levels of anxiety about money are so high that I wake up sweating clammily in my air-conditioned room. Every suggestion made casually by a friend—from the most innocuous (“Let’s grab a drink”) to the more obviously costly (“We should all go to Atlantic City for the weekend!”)—sets off a chain reaction of panic, as my brain struggles to ascertain whether my completely unmanaged budget allows such an indulgence. To dispense with hyperbole: I don’t live beyond my means, per se—I consciously try to limit splurges like dinner out, $12 martinis, and $85 theater tickets to a show that’s basically an extravagant, multilevel, live-action game of Clue played in a restored mansion (be still my theater-geek heart!). But neither do I have a real sense of exactly where my money’s going, and how I can save enough to eliminate worry about the future while still living comfortably in an urban area teeming with tasty, trendy temptations.

In fact, the prospect of delving into the jungle of my finances is so odious that I intend to keep a picture of a certain dashing someone in front of me at all times, in order to remind myself of the finer things in life (and while that thing may now be Rachel Weisz’s, it is still fine).

The name’s Bond. Savings Bond.

The name’s Bond. Savings Bond.

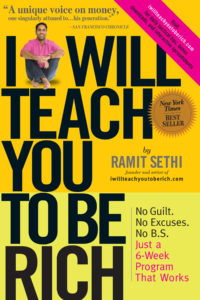

Luckily, I’ve turned to another dashing someone for help in this agonizing endeavor. His name is Ramit Sethi, and he is the author of the approachably genius, relentlessly practical, and very funny personal finance guide for twenty- and thirtysomethings I Will Teach You to Be Rich. After many false starts, I have finally succumbed to the call of this neon tome and decided to embark upon Ramit’s 6-week plan to financial literacy. Not that I’m happy about it, mind you. There are many, many things I’d rather do than think about money. Among them: Wax my kitchen floor. Ballroom dance with an emphysemic octogenarian. Cover myself with honey and roll around in a nest of fire ants.

You get the idea.

Quite honestly, I fully expect this experience to be about as fun as Harry’s final battle with Lord Voldemort. I’m right-brained—an English major (creative writing minor) by education, an assistant editor by trade. In the back of my mind, I know what actions I should be taking financially—regularly sending money to savings and retirement accounts, for example, and creating a budget so that I’m not frittering my money away on fun stuff. But savings accounts have pretty low interest rates—should I also be investing? I’ve heard that I should have a Roth IRA even though I’ve got a 401(K)—is that true? And what about the stock market—should I even go near it?? Nononononono cerebral meltdown aaaaAAAHHHhhhh….!

Luckily, Ramit realizes that many of us (me!) get overwhelmed thinking we (me!) need to manage our (my!) money perfectly, which leads us to do nothing at all. So he proposes an 85% solution, encouraging us to act and get it 85% right rather than do nothing at all. “Think about it,” Ramit writes, “85% of the way is far better than 0 percent. Once your money system is good enough—or 85% of the way there—you can get on with your life and go do the things you really want to do.” I think this guy just read my mind. Plus, I appreciate his tough-love approach—he doesn’t hesitate to call us out on our tendency to blame other people and circumstances for our fiscal ignorance. Ramit feels like the real thing.

But the bottom line is: I’ll be 26 soon. It’s more than time to get a handle on this stuff. So join me as I take on this Herculean challenge. Week 1’s post on optimizing your credit cards goes up tomorrow. (And I promise you, it’s not nearly as mind-numbingly boring as you might think.)

“After reading this book,” Ramit writes, “you’ll be better prepared to manage your finances than 99 percent of other people in their twenties and early thirties. You’ll know what accounts to open up, ways not to pay your bank extra fees, how to invest, how to think about money, and how to see through a lot of the hype that you see on TV and in magazines every day.”

Sounds like a recipe for exactly what I’m looking for—peace of mind. Ramit, teach me to be rich. If all goes as planned, at the end of these six weeks, I expect to find myself living in Paradise City.

No Comments